Reducing Survey Fatigue: Techniques to Keep Respondents Engaged

-

Tackle survey fatigue head-on with these proven techniques to keep B2C respondents engaged. Learn how shorter, targeted surveys and tools like MindProbe ensure higher completion rates and better data quality. 1. Introduction

In the rapidly evolving B2C marketplace, businesses depend on reliable consumer feedback to refine products, optimize services, and enhance customer experiences. Yet, there’s a growing challenge that threatens the quality of these vital insights: survey fatigue. As consumers are increasingly bombarded with questionnaires via emails, pop-ups, social media polls, and app notifications many are simply tuning out or providing rushed, low-effort responses.

Survey fatigue can undermine even the most well-intentioned feedback strategies, leading to reduced response rates, poor data quality, and missed opportunities to genuinely understand your audience. The good news? There are practical techniques to keep respondents engaged and ensure your surveys remain a valuable source of insights. In this comprehensive guide, we’ll delve into what survey fatigue is, explore its root causes, and offer actionable tips to combat it. We’ll also show how tools like MindProbe, an AI-powered market research platform, can help you auto-tag responses, conductsentiment analysis, and streamline data collection with minimal burden on your audience.

2. Defining Survey Fatigue

Survey fatigue refers to the decline in response quality and participation when individuals become overwhelmed or disinterested in answering surveys. This fatigue can manifest in several ways:

-

Lower Completion Rates: Respondents drop off mid-survey or ignore survey invitations altogether.

-

Reduced Data Quality: People rush through questions, provide non-committal answers, or randomly select options without reading them.

-

Negative Brand Perception: Over-surveying can lead to annoyance, damaging the very relationship you’re trying to nurture.

While survey fatigue can affect any type of research B2B or academic, for example this phenomenon is particularly acute in B2C contexts, where consumer attention is often fragmented across multiple digital channels. When it comes to designing effective surveys, understanding this phenomenon is half the battle. The other half lies in structuring your survey strategy to circumvent or mitigate fatigue triggers.

3. Why Survey Fatigue Is a Growing Problem in B2C

In the consumer-facing sector, feedback is a currency enabling brands to tailor offers, refine products, and respond to evolving customer needs. This leads many companies, large and small, to ramp up the frequency of surveys. Yet, with the ubiquity of smartphones and social media, consumers encounter:

-

Email Surveys: Post-purchase follow-ups, monthly newsletters with feedback requests, or net promoter score (NPS) surveys for brand loyalty.

-

In-App and Website Pop-Ups: Quick polls or multi-question forms triggered by certain user actions.

-

Social Media Polls: Brands seeking quick feedback on new campaign ideas or feature improvements.

-

SMS Blasts: Text messages asking for immediate ratings or short answers.

This omnipresence of surveys can be overwhelming, causing many users to feel they’re constantly being asked to offer feedback often by multiple brands on the same day. Add to this the tendency for some surveys to be lengthy or poorly designed, and you have a recipe for widespread disengagement.

4. Root Causes of Survey Fatigue

4.1 Excessive Survey Length

When a user opens a survey and finds a massive list of questions, they may feel intimidated or simply too busy to complete it. Long or meandering surveys amplify dropout rates and encourage superficial responses.

4.2 Frequency Overload

Sending out multiple surveys in a short span especially without segmenting your audience triggers the “not another survey!” reaction. Consumers who receive too many requests from the same brand are more likely to tune out or unsubscribe from future communications.

4.3 Irrelevant or Repetitive Questions

Users lose interest fast if questions don’t apply to them or if they repeat common knowledge that’s already available in their account data (e.g., asking a customer about their location when you already have their shipping details). Poor question design wastes time and fosters frustration.

4.4 Lack of Incentives or Value

Modern consumers expect an exchange of value. If they see no clear benefit or reason for spending their time, they have little motivation to engage. Even if it’s not a discount or free product, explaining *why* their feedback matters can go a long way.

5. Impacts of Survey Fatigue on Data Quality

As survey fatigue sets in, brands face diminishing returns:

1. High Drop-Off Rates

-

Surveys remain partially completed, denying you the full picture.

2. Skewed Results

-

Only the most motivated or dissatisfied customers respond, potentially biasing your data toward extremes.

3. Superficial Answers

-

Rushed or random responses lead to **invalid conclusions**.

4. Wasted Resources

-

Time and budget spent distributing and analyzing flawed data are effectively lost.

5. Brand Erosion

-

Over-surveying or poorly designed questionnaires can annoy customers, making them less receptive to future engagement and possibly damaging brand perception.

In short, survey fatigue can undermine both research validity and customer relationships, negating the intended benefits of collecting feedback in the first place.

6. Techniques to Keep Respondents Engaged

With an understanding of survey fatigue and its causes, let’s explore practical strategies to maintain respondent enthusiasm.

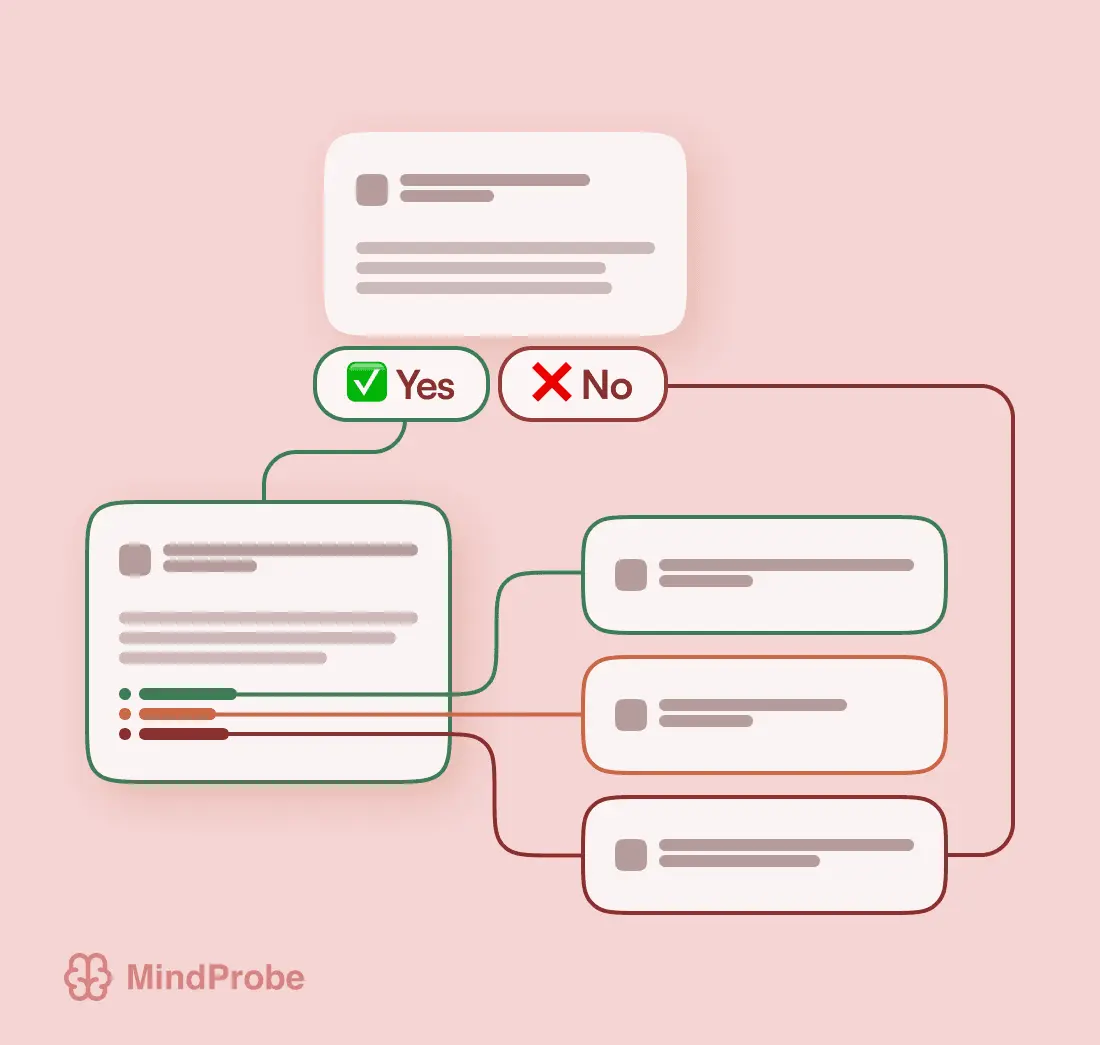

6.1 Keep Surveys Concise and Focused

Less is more when it comes to preventing fatigue:

-

Prioritize Must-Know Questions: Distinguish essential data points from “nice-to-have” items.

-

Set Time Expectations: If your survey takes 2 minutes on average, let respondents know upfront.

-

Use Progress Indicators: A visual progress bar can help users see how far they have to go, reducing anxiety about survey length.

6.2 Use Personalization and Targeting

Generic surveys have a higher chance of feeling irrelevant:

-

Segment Your Audience: Tailor questions to user traits like purchase history, location, or engagement level.

-

Address Respondents by Name (Where Appropriate): A touch of personalization shows you value them as individuals, not just data points.

6.3 Employ Branching Logic Intelligently

Branching (or skip) logic ensures respondents only see relevant questions based on previous answers:

-

Example: If someone indicates they haven’t used a particular feature, skip any follow-up questions about that feature.

-

Benefit: Reduces survey length for certain respondents and enhances question relevance.

6.4 Incorporate Varied Question Formats

Respondent engagement drops when every question is the same multiple-choice format:

-

Rating Scales: Great for quick satisfaction checks.

-

Sliding Scales: Offer a more interactive approach to rating opinions.

-

Open-Ended Prompts: Allow deeper expression especially powerful when paired with AI-powered analysis tools like MindProbe that can auto-tag responses for themes.

-

Visual Elements: Picture-based questions or emojis can engage respondents in a lighthearted way if appropriate for your brand.

6.5 Offer Meaningful Incentives (When Appropriate)

A small token of appreciation can boost participation:

-

Discount Codes: Especially effective in e-commerce contexts.

-

Exclusive Previews: Grant access to new features or a sneak peek at upcoming products.

-

Community Recognition: Publicly thank top contributors or highlight user suggestions implemented by your brand.

Caution: Overusing incentives might attract respondents who only care about freebies, potentially skewing your data. Strike a balance between motivating engagement and preserving data authenticity.

6.6 Time Your Surveys Strategically

Sending surveys at the right moment can significantly improve completion rates:

-

Post-Purchase: Capture fresh impressions within a few days of a transaction.

-

User Milestones: On the anniversary of their sign-up or after crossing a certain usage threshold in an app.

-

Avoid Peak Work Hours: People are busy. Sending a consumer survey mid-morning on a Monday might be less effective than early evening when they have downtime.

6.7 Respect Privacy and Transparency

Consumers increasingly value data privacy:

-

Be Clear on Usage: Clearly explain how you’ll use their responses (e.g., “We want to improve our shipping experience”).

-

Avoid Overly Intrusive Questions: Asking for too much personal data without context raises suspicion and exit rates.

7. How MindProbe Tackles Survey Fatigue

While design strategies are key to engagement, the right technology can further streamline your feedback collection efforts. That’s where MindProbe, an AI-powered market research platform, becomes invaluable.

7.1 AI-Powered Sentiment Analysis & Auto-Tagging

Writing out open-ended responses can strain respondents, but it also provides rich, qualitative data. MindProbe’s sentiment analysis and auto-tagging features make this data easy to parse, so you can keep your surveys concise while still capturing valuable feedback. The platform quickly classifies comments (e.g., “shipping too slow,” “love the packaging&rdquo

and scores them as positive, negative, or neutral preventing you from needing to read thousands of lines of text manually.

and scores them as positive, negative, or neutral preventing you from needing to read thousands of lines of text manually.7.2 Real-Time Data & Adaptive Distribution

MindProbe’s real-time dashboard shows response rates, dropout points, and average completion times. If you spot an uptick in drop-offs at a particular question, you can edit the survey on the fly perhaps by rephrasing the question or removing it entirely. This adaptive approach minimizes the build-up of fatigue across your audience.

7.3 Short Surveys, Big Impact

Given that MindProbe streamlines analytics and segments your audience effectively, you can craft multiple shorter surveys rather than one lengthy one. These bite-sized questionnaires reduce fatigue and allow you to address specific issues in depth.

7.4 7-Day Trial, No Free Subscriptions

Unlike platforms with limited free tiers, MindProbe offers a 7-day full-access trial letting you experience all features (from sentiment analysis to advanced branching) before deciding on a paid plan. This approach ensures you can test whether smaller, more focused surveys reduce fatigue in your audience without long-term financial commitments.

8. Real-World Examples and Case Studies

8.1 E-Commerce Platforms

Scenario: A mid-sized fashion retailer sees plummeting response rates on its post-purchase surveys. Many customers abandon the survey halfway.

-

Technique: They shorten the survey from 15 to 5 questions, focusing on shipping satisfaction, product fit, and overall experience. They also add a branching logic path for first-time buyers vs. returning buyers.

-

Result: Survey completion rates jump from 30% to 60%. The retailer uncovers a shipping bottleneck affecting a specific region, promptly resolving it and improving regional sales by 10% in the following quarter.

8.2 Subscription Services

-

Scenario: A monthly snack box service sends out multiple surveys on sign-up, after first delivery, and mid-subscription to gather feedback. Engagement dips as subscribers feel over-surveyed.

-

Technique: They consolidate their questionnaires into one monthly check-in that’s triggered after the user receives a box. Questions adapt based on previous feedback, removing repetitive sections.

-

Result: Subscribers appreciate the streamlined approach, and feedback becomes more actionable, leading to higher satisfaction with new snack selections.

8.3 Event Feedback

-

Scenario: A B2C event organizer regularly hosts large-scale conventions and expos, sending out lengthy feedback forms post-event.

-

Technique: They switch to a short mobile survey accessible via QR codes displayed throughout the venue, collecting immediate on-site impressions.

-

Result: Higher participation (up to 65%) and richer insights about session preferences, queue times, and venue layout. Real-time data even helps them fix bottlenecks on the same day of the event.

9. Future-Proofing Your Survey Strategy

As consumer expectations evolve, so should your approach to surveys:

1. Embrace Omnichannel Collection

-

Combine in-app prompts, website pop-ups, email surveys, and offline QR codes but coordinate them so you’re not spamming the same user across every channel.

2. Integrate Surveys with CRM Data

-

Sync your survey responses with your CRM or marketing automation tools to build a holistic view of each customer. This helps you set up targeted follow-ups and avoid repetitive questions.

3. Leverage AI for Continuous Optimization

-

AI-driven platforms like MindProbe can learn from historical response patterns, suggesting the best times to send surveys or the optimal question length to reduce fatigue.

4. Test and Iterate

-

Treat every survey launch as an experiment. Monitor drop-off points, timing, and question effectiveness. Then adjust your design, retest, and refine.

5. Stay Aligned with Privacy Regulations

-

As data protection laws evolve (e.g., GDPR in Europe), ensure your surveys comply with regional regulations. Being transparent and respectful of privacy fosters trust and engagement.

By adopting these measures, you’ll stay agile, ensuring your surveys remain effective long-term even as your audience grows or market dynamics shift.

10. Conclusion

Survey fatigue is a formidable challenge in the B2C landscape, where consumers are saturated with feedback requests from every corner of the digital realm. Yet, the importance of quality insights remains undeniable without them, brands risk falling behind in product innovation, customer satisfaction, and competitive positioning.

The good news? By focusing on brevity, relevance, timing, and engagement, you can keep your surveys fresh and actionable. Harnessing AI-driven platforms like MindProbe can further streamline the process, providingsentiment analysis, auto-tagging, and real-time analytics that enhance both survey design and data interpretation. The end goal is clear: gather meaningful, reliable feedback without overwhelming respondents.

As you refine your survey strategy, remember that less is more. Shorter, well-targeted surveys deployed at the right time often yield better results than sprawling questionnaires. And when respondents know you’re actually listening and making changes based on their insights, they’re more likely to engage the next time around, reinforcing a virtuous cycle of feedback and improvement.

Ready to tackle survey fatigue head-on? Start by auditing your existing surveys for length, frequency, and relevance. Then consider leveraging MindProbe’s 7-day trial to experiment with advanced features that keep respondents engaged and your brand in positive standing with customers eager to share, rather than shun, their opinions.

-