Categories

Tags

Archives

Missing R&D Credits? Form 6765 Simplified for 2026

-

Posted by Books Merge Filed in Business #Business #finance #accounting services #Bookkeeping Services #Payroll services #taxation 96 views

Form 6765 instructions explain how businesses claim the federal R&D tax credit by identifying qualified research expenses, choosing a calculation method, and filing correctly with the IRS.

Table of Contents

-

Introduction to IRS Form 6765

-

What Is Form 6765 Used For?

-

Who Qualifies for the R&D Tax Credit?

-

Understanding Qualified Research Expenses (QREs)

-

Choosing Between ASC and Regular Credit Method

-

Step by Step IRS Form 6765 Instructions

-

Payroll Tax Offset for Startups

-

What Changed in 2025?

-

Common Filing Mistakes to Avoid

-

Why Accurate Financial Records Matter

-

How BooksMerge Supports R&D Credit Claims

-

Conclusion

-

Frequently Asked Questions

Introduction to IRS Form 6765

Innovation drives growth, but innovation also costs money. The IRS created Form 6765 to reward businesses that invest in research and development. These Form 6765 Instructions help companies reduce tax liability while staying compliant with federal rules.

If you design software, improve manufacturing processes, or develop new products, this form may unlock real tax savings. The key lies in accuracy, documentation, and understanding how the credit works.

What Is Form 6765 Used For?

Form 6765 allows businesses to claim the Research and Development Tax Credit under Internal Revenue Code Section 41. Companies use it to calculate and report eligible R&D expenses on their federal income tax return.

The credit reduces income tax dollar for dollar. Qualified startups can also apply part of the credit against payroll taxes.

Who Qualifies for the R&D Tax Credit?

Many business owners assume only large tech firms qualify. That belief misses the mark.

You may qualify if your business:

-

Develops or improves products, software, or processes

-

Solves technical problems through experimentation

-

Relies on engineering, computer science, or hard sciences

-

Faces uncertainty in design or methodology

Industries that often qualify include software, manufacturing, architecture, construction, biotech, and engineering.

Business size does not matter. Profitability does not matter. Even companies with losses can benefit.

Understanding Qualified Research Expenses (QREs)

What are QREs?

QREs include costs directly tied to qualified research activities. The IRS defines them clearly.

Common QRE Categories

-

Wages paid to employees performing R&D

-

Supplies used during experimentation, excluding capital items

-

Contract research costs, typically at 65 percent of total paid

-

Cloud computing costs when used for development and testing

You must connect each expense to a qualified activity. Strong documentation protects your claim during audits.

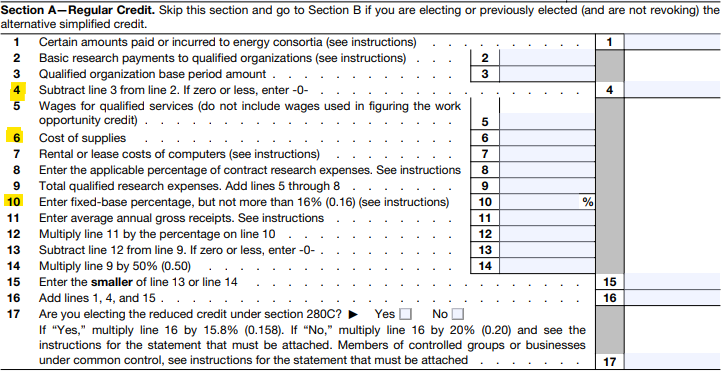

Choosing Between ASC and Regular Credit Method

One of the most important instructions Form 6765 covers is credit calculation.

Regular Credit Method

-

Uses historical research spending

-

Offers higher credits in some cases

-

Requires detailed records from prior years

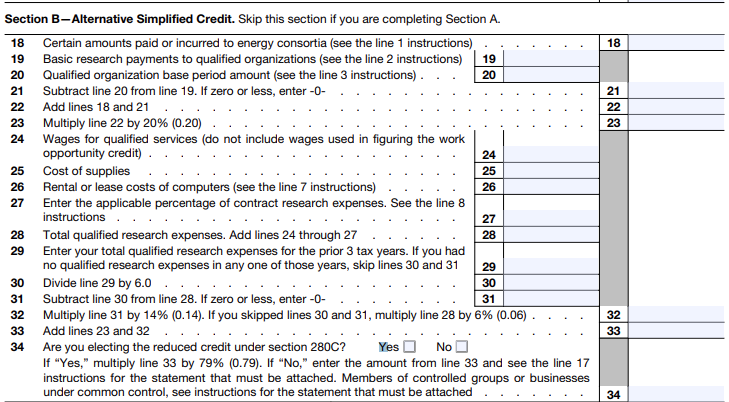

Alternative Simplified Credit (ASC)

-

Easier to calculate

-

Uses average QREs from the previous three years

-

Often preferred by small and mid sized businesses

How to calculate ASC vs regular method?

ASC equals 14 percent of current year QREs above 50 percent of the prior three year average. The regular method uses a complex base amount formula.

Most companies choose ASC due to simplicity and lower audit risk.

Quick Tip: A simple, organized overview of essential IRS form List to help individuals and businesses file taxes accurately, stay compliant, and avoid costly mistakes.

Step by Step IRS Form 6765 Instructions

Here is a simplified walkthrough based on official IRS guidance.

Part I: Current Year Credit

-

Enter total QREs

-

Choose calculation method

-

Compute total credit

Part II: Regular Credit

-

Required if you select the regular method

Part III: ASC Credit

-

Required if you select ASC

Part IV: Payroll Tax Election

-

Startups elect payroll offset here

Part V and VI

-

Controlled groups and passive activity rules

Attach Form 6765 to your income tax return. File it with Form 1120, 1065, or Schedule C.

Payroll Tax Offset for Startups

Can startups use payroll offset?

Yes, qualified small businesses can apply up to $500,000 of R&D credit against employer payroll taxes.

To qualify, the business must:

-

Have less than $5 million in gross receipts

-

Have no gross receipts before the past five years

This option helps startups conserve cash while investing in growth.

What Changed in 2025?

Form 6765 instructions 2025 reflect increased scrutiny and expanded documentation requirements.

Key updates include:

-

Stronger emphasis on business component details

-

Clear linkage between expenses and activities

-

Continued requirement to amortize R&D expenses under Section 174

The IRS now expects structured narratives, not vague descriptions. Businesses that prepare early reduce compliance risk.

Common Filing Mistakes to Avoid

Even strong claims fail due to preventable errors.

Avoid these mistakes:

-

Overstating employee time percentages

-

Including non qualifying expenses

-

Lacking project documentation

-

Mixing routine work with R&D activities

-

Filing without professional review

Accuracy builds credibility with the IRS and strengthens long term tax planning.

Why Accurate Financial Records Matter

Clean books support every R&D credit claim. Without reliable accounting, credit calculations become guesswork.

Financial literacy helps businesses understand cost allocation, payroll mapping, and expense categorization. If you want deeper insight, explore this helpful resource on small business financial literacy statistics to see how strong accounting improves decision making: Financial Literacy Statistics

How BooksMerge Supports R&D Credit Claims

BooksMerge helps businesses navigate complex tax credits with clarity and confidence. Our team aligns accounting records, payroll data, and project documentation with IRS Form 6765 instructions.

We focus on:

-

Accurate QRE identification

-

ASC and regular method analysis

-

Audit ready documentation

-

End to end filing support

For expert guidance, call +1-866-513-4656 and speak with professionals who understand compliance and strategy.

Conclusion

Form 6765 offers real value when handled correctly. The IRS provides clear guidance, but success depends on understanding eligibility, choosing the right method, and maintaining strong documentation.

When businesses follow official irs form 6765 instructions, they reduce risk and maximize benefit. With proper planning and expert support, the R&D tax credit becomes a powerful growth tool.

Frequently Asked Questions

What is Form 6765 used for?

Form 6765 calculates and claims the federal R&D tax credit for businesses that incur qualified research expenses during innovation and development activities.

Who qualifies for R&D tax credit?

Businesses that perform technical research, face uncertainty, and use experimentation in product or process development may qualify, regardless of size or profitability.

What are QREs?

QREs are qualified research expenses such as wages, supplies, and contract research costs directly tied to eligible R&D activities.

How to calculate ASC vs regular method?

ASC uses a three year average of QREs for a simpler calculation. The regular method uses historical base amounts and requires more detailed records.

What documents are required?

Payroll reports, expense records, project descriptions, technical documentation, and time tracking data support a valid Form 6765 claim.

Can startups use payroll offset?

Yes. Qualified startups can apply up to $500,000 of R&D credit against employer payroll taxes instead of income tax.

What changed in 2025?

The IRS increased documentation expectations and continues to enforce R&D expense amortization rules under Section 174.

If you want reliable help with instructions for Form 6765, professional guidance makes all the difference. BooksMerge stands ready to support your compliance and growth journey.

Read Also: Form 6765 Instructions

-